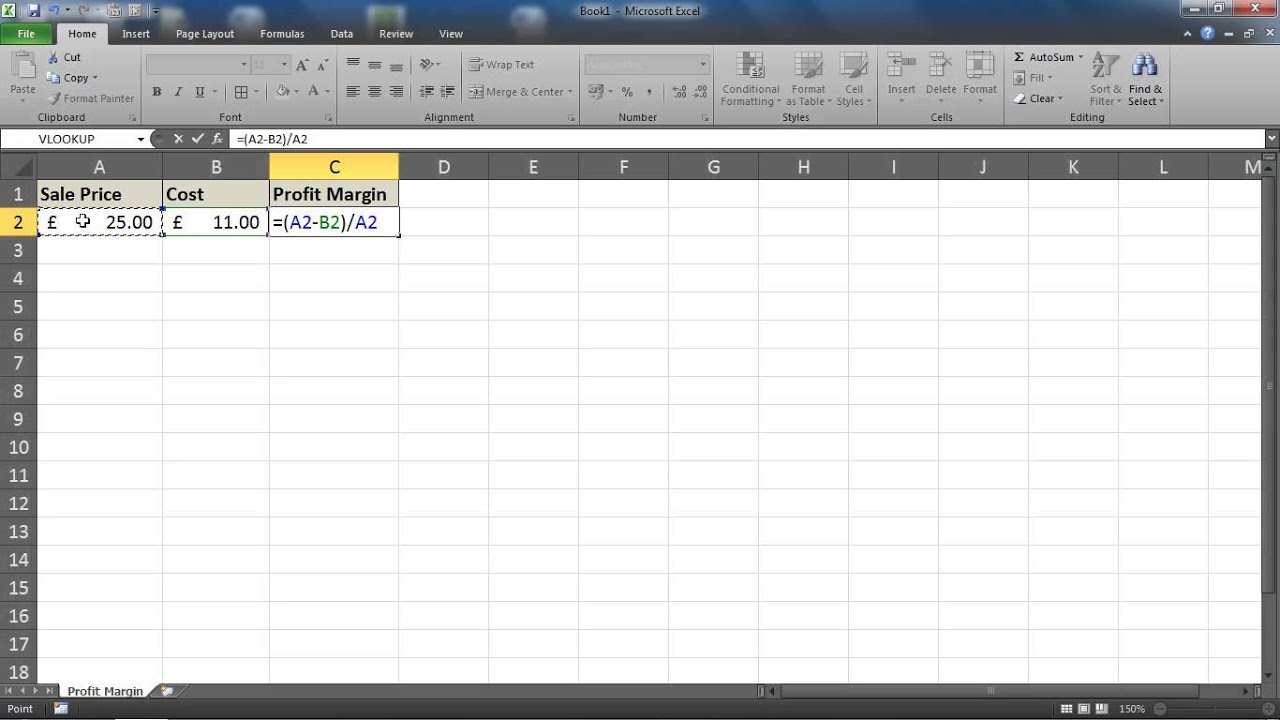

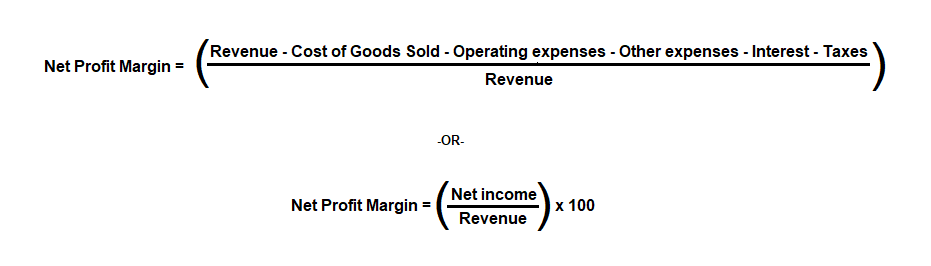

Forecast profit margin formula

Emme divides her monthly gross profit of 5500 by her 10000 of sales to get a profit margin of 55. For example with a Forecast value of 100000 and an Actual value of 112000.

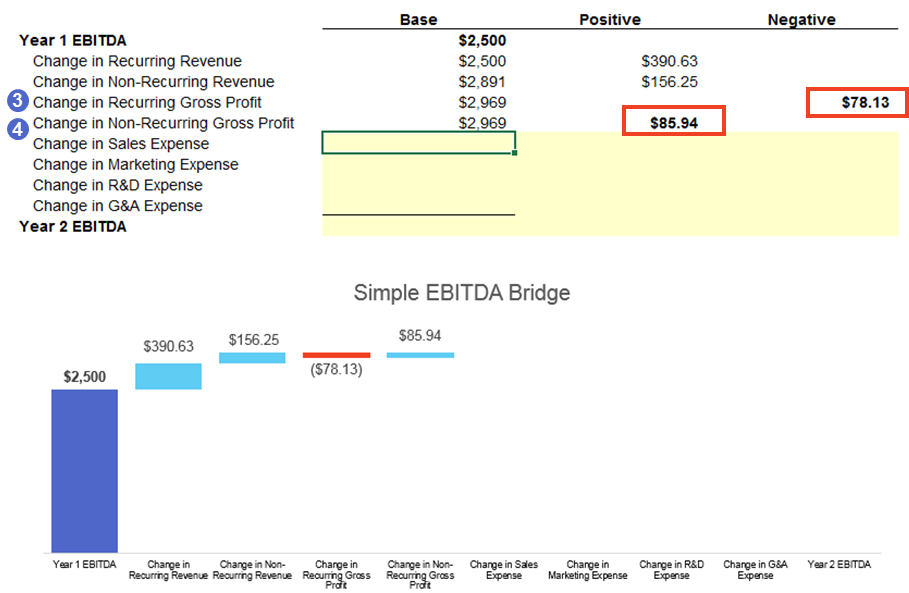

How Do I Calculate An Ebitda Margin Using Excel

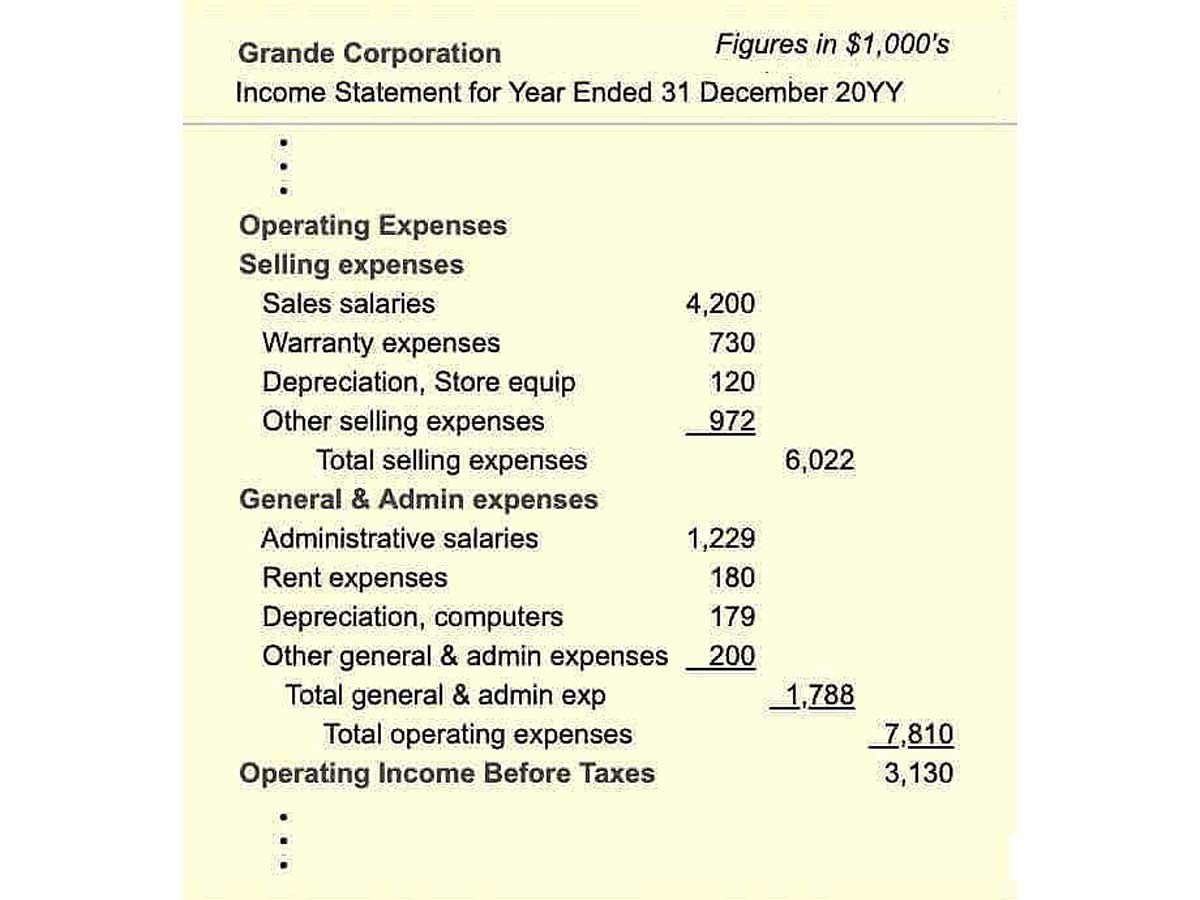

Resource costs overhead profit margin Total average labor hours.

. The baseline value is subtracted from the new value and the result is divided by the baseline value. ROI is your profit per item divided by how much it cost to buy the item. The general formula where x is the variance is.

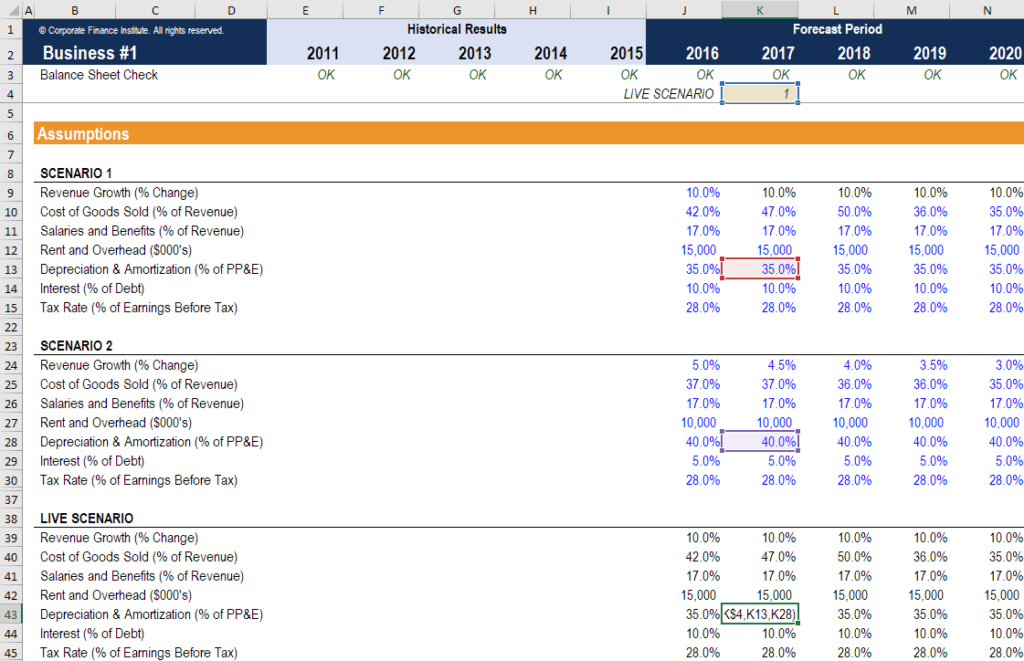

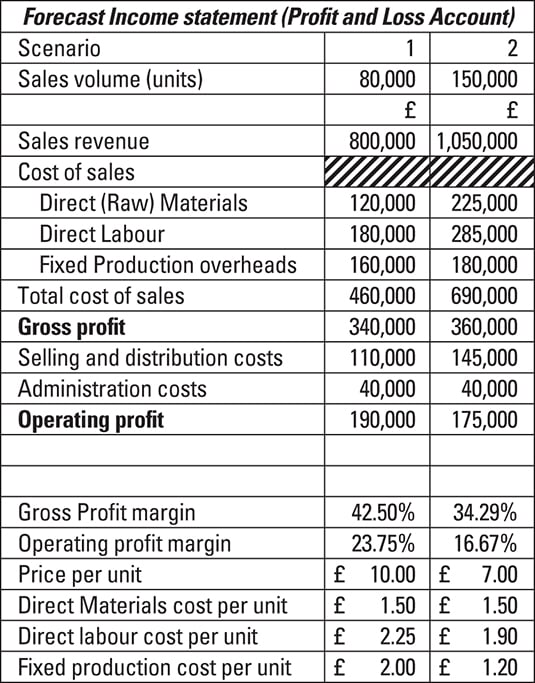

Profit Margin Gross Profit Margin Contribution Margin EBITDA Margin Pre-Tax Profit Margin Net Profit Margin Operating Margin Operating Cash Flow Margin. Assuming everyone has 2000 available hours you can calculate their billing rate like this. Understanding your ROI and profit margin will help you with this.

X profit price. It aids investors in analyzing the companys performance. 6 to 30 characters long.

Target profit fixed costs contribution margin per unit projected sales 140000 14000 19 8105 Bountiful Blankets needs to sell 8105 blankets during the third quarter in order to meet their target profit goal of 140000. Get 247 customer support help when you place a homework help service order with us. ABCs gross profit.

Return on Average Assets Formula. 5 of the fixed costs 20mm to. Get all the latest India news ipo bse business news commodity only on Moneycontrol.

The general formula where x is profit margin is. Statistics and Analytics has become the part and parcel of business houses and to forecast the expected demand of a particular data a company is required to opt for different statistical tools. In the table shown we have price and cost but profit is not broken out separately in another column so we need to calculate profit by subtracting Cost from Price.

If you only earned 2 profit that would be a 20 ROI. Here we discuss formula to calculate incremental cash flow with example components advantages disadvantages. EBITDA stands for earnings before interest taxes depreciation and amortization.

Gross profit is the profit a company makes after deducting the costs of making and selling its products or the costs of providing its services. Definition Example and Formula. They apply the CVP analysis formula.

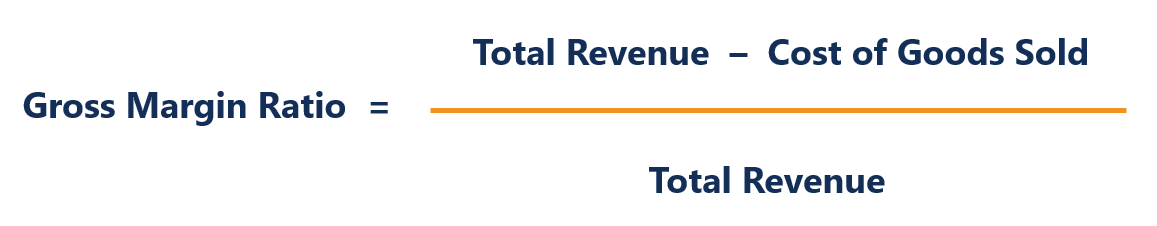

Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000. Return On Average Equity Formula. EBITDA - Earnings Before Interest Taxes Depreciation and Amortization.

Net profit margin is the ratio of net profits to revenues for a company or business segment. To get your profit margin divide your estimated average monthly gross profit by your estimated monthly sales. Thus the level of production along with the contribution margin are essential factors in developing your business.

Whether or not your ROI is good depends on a lot of factors. Get 247 customer support help when you place a homework help service order with us. Variable costs were 1.

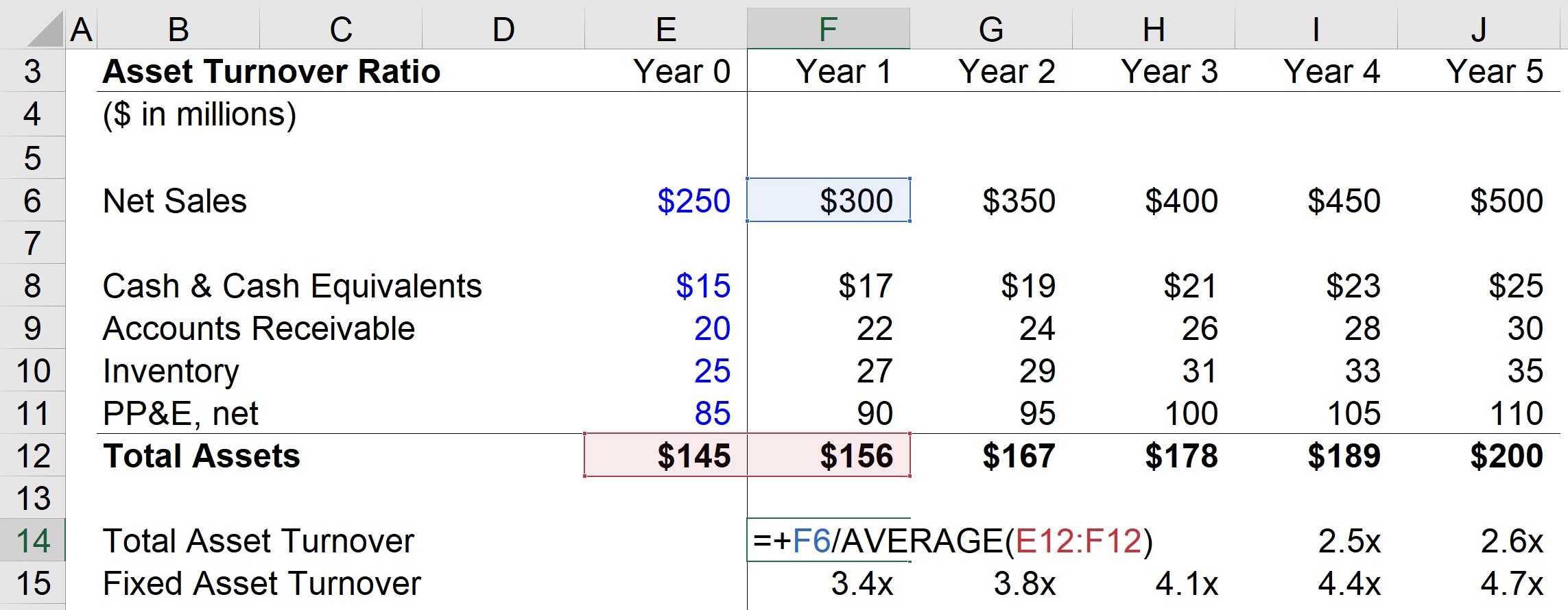

To start our forecast of accounts payable the first step is to calculate the historical DPO for 2020. DPO can be calculated by dividing the 30mm in AP by the 100mm in COGS and then multiplying by 365 days which gets us 110 for DPO. EBITDA and net profit margin.

Read more and its effect. Contribution margin calculation is one of the important methods to evaluate manage and plan your companys profitability. Leverage our proprietary and industry-renowned methodology to develop and refine your strategy strengthen your teams and win new business.

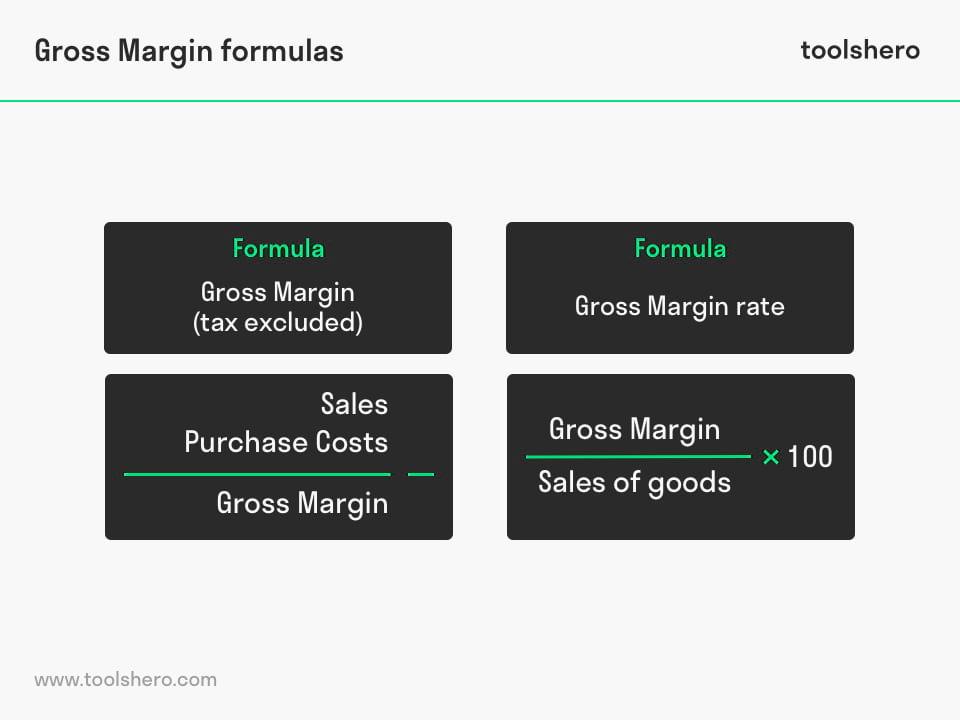

We are an Open Access publisher and international conference Organizer. EBITDA is one indicator of a companys. Gross Profit Margin Formula.

We own and operate 500 peer-reviewed clinical medical life sciences engineering and management journals and hosts 3000 scholarly conferences per year in the fields of clinical medical pharmaceutical life sciences business engineering and technology. It is as good as the inputs to the estimates. For example with a Forecast value of 100000 and an Actual value of 112000 we want to return a variance of 12.

Practically incremental cash flows are complicated to forecast. Notation Effective Date from now Termination Date from now Underlying Rate 1 x 4 1 month 4 months 4-1 3 months LIBOR 1 x 7 1 month 7 months. Follow our practical advice to guide yourself through the maze of IT investment.

The concept of gross profit is fundamental to management cost accountants and investors because it allows them to forecast future activities and create budgets. Must contain at least 4 different symbols. ASCII characters only characters found on a standard US keyboard.

Typically expressed as a percentage net profit margins show how much of each dollar collected by a. Further the contribution margin formula provides results that help you in taking short-term decisions. We can see the benefits of DOL from the margin expansion of 158 throughout the forecast period.

It is the percentage of selling price that is turned into profit whereas profit percentage or markup is the percentage of cost price that one gets as profit on top of cost priceWhile selling something one should know what percentage of profit one will get on a particular investment so. Column D as a percentage. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

So if you bought an item for 10 and earned 10 profit that would be a 100 ROI. The concept of variance requires a baseline value and a new value. Profit margin is calculated with selling price or revenue taken as base times 100.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Lets say the average labor cost at Leslies company is 100000 per employee overhead is 20000 and their goal is a 20 profit margin 120000 x 20 24000. Get the latest financial news headlines and analysis from CBS MoneyWatch.

For purpose of simplicity we will just carry forward this assumption across the entire forecast. IT PRO is a comprehensive technology news reviews hub for IT professionals.

Revenue Projection Formula Plan Projections

Profit Margin Percentage Formula Youtube

Overhead Expense Role In Cost Accounting And Business Strategy

Asset Turnover Ratio Formula And Calculator Excel Template

Profit Margin Calculator The Importance Of Revenue Forecasting

How To Calculate Margin Analysis For Saas Formula Examples

Gross Margin Ratio Learn How To Calculate Gross Margin Ratio

Projecting Income Statement Line Items Step By Step Guide

How To Build And Use Ebitda Bridges Waterfalls By Ramin Zacharia Medium

10 Ratios Of Management And Cost Accounting Dummies

How To Calculate Margin Analysis For Saas Formula Examples

Average Profit Margin By Industry Business Profit Margins

Overhead Expense Role In Cost Accounting And Business Strategy

Training Modular Financial Modeling Historical Forecast Model Forecasts Other Financial Statement Items Modano

Gross Margin A Powerful Financial Tool Toolshero

Subscription Revenue Forecast Example Example Uses

Key Benchmark Indicator Rule Of 40 Definition